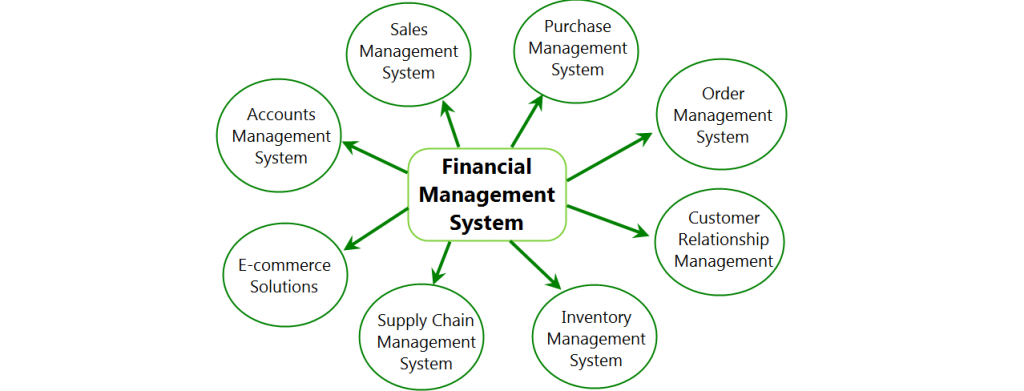

Finance Management System Module

DialUrSearch Pvt. Ltd. Provides Financial Management Information Systems software that accumulate and analyze financial

data in order to make good financial management decisions in running the business

The basic objective of the financial information system is to meet the firm's financial obligations as they come due, using the minimal

amount of financial resources consistent with an established margin of safety. Outputs generated by the system include accounting reports, operating and capital budgets, working capital reports, cash flow forecast, and various What-If Analysis reports. The evaluation of financial data may be performed through ratio analysis, trend evaluation, and financial planning modeling. Financial planning and forecasting are facilitated if used in conjunction with a Decision Support System (DSS)..

FMS Module Highlights

This software accelerates your financial close, provides strong expense management, offers streamlined and auditable revenue management and ensures complete real-time visibility into the financial performance of the business.

- Collect accurate, timely, complete, reliable, consistent information and Provide complete audit trail to facilitate audits.

- Support budget preparation and execution

- Execute with confidence using built-in or third-party sales tax computation as well as reporting and analysis solutions

- Flexibility of reporting and additional control over expenditure

- Focus on data analysis rather than data entry with unmatched flexibility and control

DialUrSearch Pvt. Ltd. designed FMS software to

Tautomate and streamline your financial processes with tools and controls to support complex legislative requirements and create value through timely financial monitoring, including:

- Accounts receivable, lockbox, credit and collections management.

- Accounts payable, electronic funds transfer, automated order matching.

- General ledger, allocations, consolidations and eliminations.

- Cash management, bank reconciliation, and statement interfaces.

- Payroll, fixed asset,tax management, Budgeting, forecasting, and planning.